|

Doerun Gin Co.

Market Data

News

Ag Commentary

Weather

Resources

|

UNH Stock Just Popped to New 4-Month Highs, But This Analyst Warns UnitedHealth Could Still Fall 20% From Here/Unitedhealth%20Group%20Inc%20%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Shares of healthcare conglomerate UnitedHealth Group (UNH) have been under pressure this year. Already down 30.3% on a year-to-date (YTD) basis, the company's earnings have missed Street expectations in two out of the three quarterly results that have been released this year. Looking at this, the assertions of TD Cowen analyst Ryan Langston seem logical, as the analyst reiterated a “Hold” rating on the stock. Moreover, the price target of $275 indicates a downturn of about 22% from current levels. However, the shares' valuations have reached such levels of comfort that they prompted legendary investor Warren Buffett to pick up about 5 million shares of the company for about $1.6 billion.

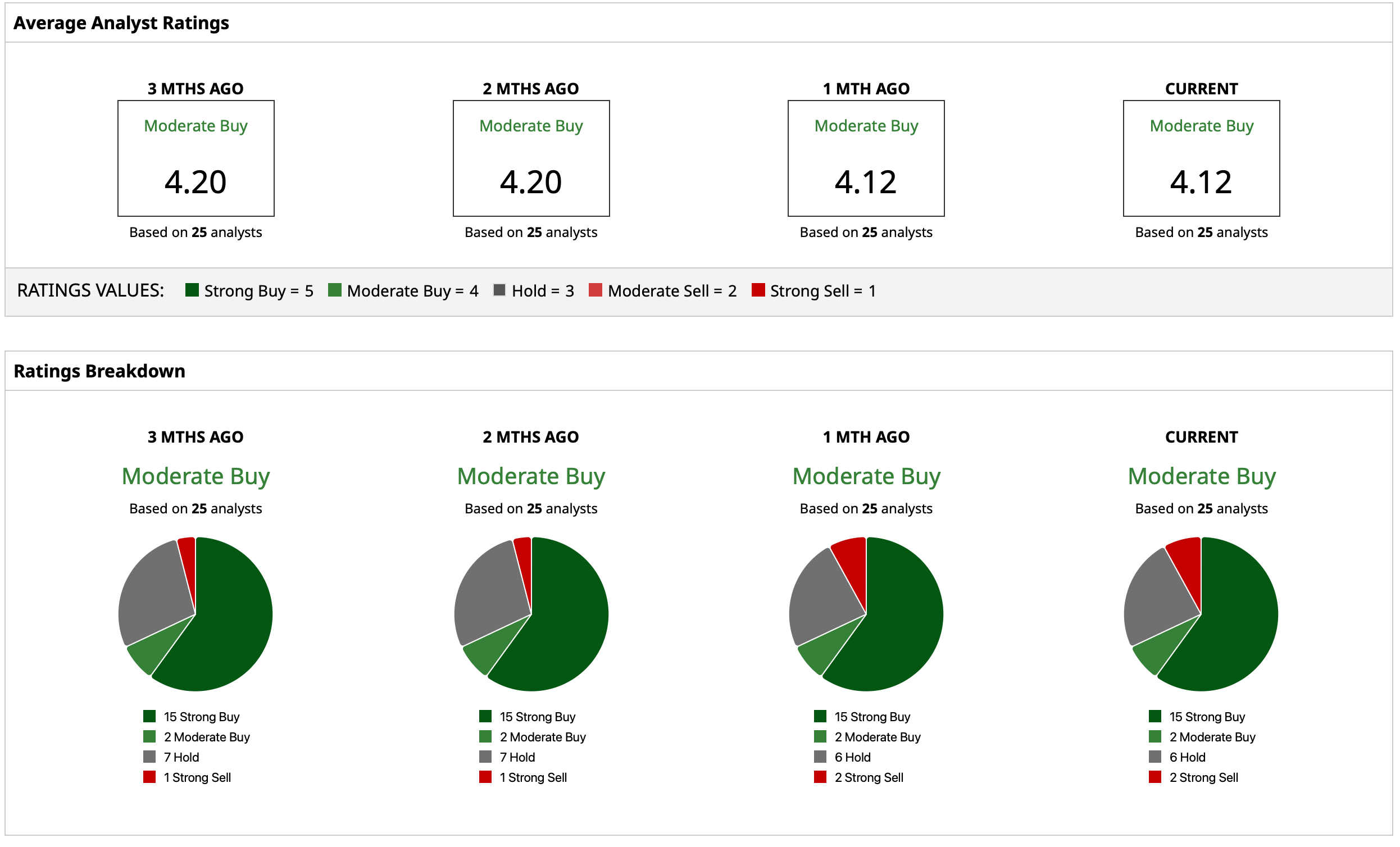

About UnitedHealthFounded in its current form in 1977, UnitedHealth is a large U.S. healthcare and well-being company that operates through two main businesses: UnitedHealthcare (insurance, care delivery) and Optum (health services, technology, pharmacy). It offers health insurance, managed care, Medicare & Medicaid plans, physician services, data analytics, pharmacy benefit management, home health care, etc. Valued at a market cap of $319.3 billion, UnitedHealth is the largest insurer in the U.S., with the UNH stock also offering a dividend yield of 2.41%. Further, the company has been raising dividends consecutively over the past 15 years (it did so by 5% in the most recent quarter as well, to $2.21 per share), and with a payout ratio of just 33.72%, UnitedHealth's track record of raising dividends every year is expected to remain intact. This brings us to the question: Is the UNH stock a suitable investment option now? Will TD Cowen be proven right, or will the Oracle of Omaha's bet on UNH pay off? Let's find out. Mixed Q2, but Fundamentals in a Position of StrengthUnitedHealth's numbers for the most recent quarter painted a conflicting picture, with revenues rising on a year-over-year (YOY) basis and surpassing Street estimates, but earnings declining from the previous year and missing the same. Revenues of $111.62 billion denoted an annual growth of 12.9%. Optum, which made up just over 60% of the quarterly revenues of the company, saw its sales rise by 6.8% from the previous year to $67.2 billion. Earnings of $4.08 per share, however, reflected a sharp decline of 40% from the prior year, while also coming in lower than the Street expectations of $4.45 per share. Although this marked the second consecutive quarter of earnings misses from the company, over the past nine quarters, UNH's earnings have reported a beat on seven occasions. Yet, a worrying signal is that UnitedHealth has cut its revenue outlook for the year to be between $445.5 billion and $448.0 billion, although it provided better clarity after the suspension of the outlook altogether in May 2025. Further, earnings per share projections have also fallen sharply to “at least $14.65” from $24.65 to $25.15 per share earlier, which itself was a reduction as well. Coming back to the latest results, UNH reported cash flow from operating activities of $12.6 billion for the six months ended June 30, 2025. This marked a significant jump of more than 60% on a YOY basis, as the company closed the quarter with a cash balance of $32 billion, which was much higher than its short-term debt levels of $5.7 billion. Strategic Transition Bodes WellUNH stock has had a tough time this year. Yet, since my last analysis, UNH has regained some of its lost mojo to rally by 25%. Other than the Buffett spike and the valuation reaching comfortable levels, the sheer presence of UnitedHealth as a giant in the insurance space gives it a unique competitive edge. UnitedHealth Group today looks far different from a straightforward health insurer. Over time, it has quietly assembled one of the most diversified health-care businesses in the world, creating multiple and often complementary revenue streams. Among the biggest shifts underway is its steady move away from the traditional fee-for-service billing model toward value-based care. In practice, this approach relies on deep pools of patient data to group individuals with similar profiles so treatment plans can be tailored more effectively. The larger the data set, the better the match, which improves both patient outcomes and cost management. With global reach and records on millions of patients, UnitedHealth already has the scale needed to make this model work. Further, technology is becoming a second pillar of that transition. Management has said artificial intelligence (AI) initiatives should trim close to a billion dollars from annual costs by fiscal 2026. Beyond cutting expenses, those systems allow managers to act faster, spot risks earlier, and identify more efficient ways of delivering care. The company has also begun running a digital marketplace for health-related AI applications that, if it takes off, could become a key distribution point for medical software in the U.S. All of this feeds into Optum, widely seen as the group’s most valuable business. The subsidiary has become a growth engine with several distinct parts. Optum Rx oversees the pharmacy benefit and prescription drug segment, which is forecast to expand well ahead of inflation in the coming years. Optum Health runs clinics and provides in-person and virtual visits. Even with recent cuts to government programs, roughly 60% of UnitedHealth’s customers come from the commercial market, helping cushion any public-sector slowdowns. Optum Insight, the third major arm, supplies technology, analytics, and data services to hospitals, insurers, and governments. Its operating profit jumped 83% YOY, underscoring its contribution. Together, the insurance operations and Optum’s service businesses give UnitedHealth unrivaled scale in the managed-care industry. That breadth has created a durable competitive position and leaves the company well placed to keep expanding shareholder value over time. Analyst Opinions on UNH StockOverall, analysts have assigned a rating of “Moderate Buy” for the UNH stock, with a mean target price of $316.29, which has already been surpassed. The high target price of $440 denotes an upside potential of about 25% from current levels. Out of 25 analysts covering the stock, 15 have a “Strong Buy” rating, two have a “Moderate Buy” rating, six have a “Hold” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|