|

|

Doerun Gin Co.

Market Data

News

Ag Commentary

Weather

Resources

|

Oil Rally Hinges on Resistance Levels Amid Geopolitical Jitters

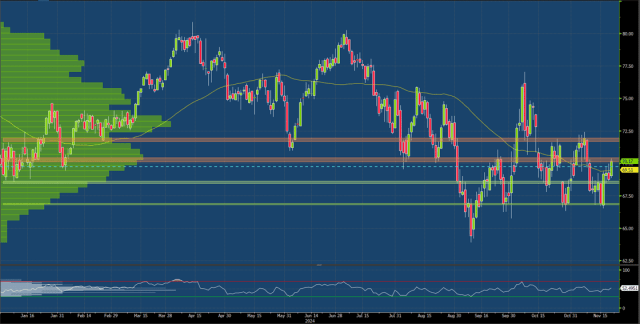

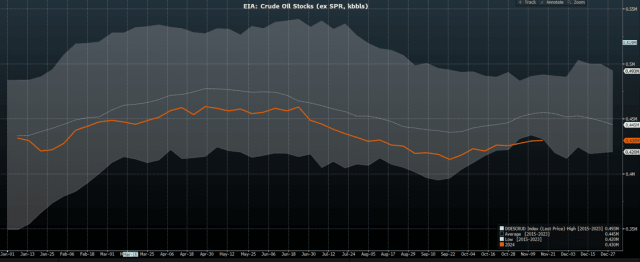

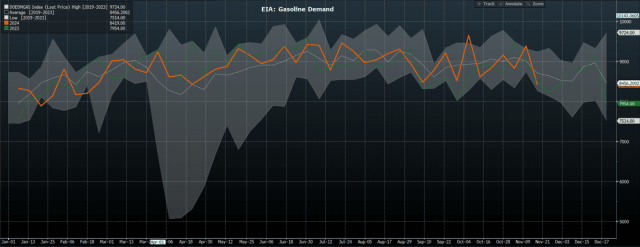

WTI Crude Oil Futures (January) Yesterday’s Settlement: 68.75, down -0.49 [-0.71%] WTI Crude Oil futures finished lower yesterday after once again making early morning highs in the European session. U.S. traders sold crude aggressively into the U.S. open. European buying into aggressive American selling on the open has been a rinse-and-repeat pattern in crude this week.  This morning, WTI futures are showing promising strength through the European session once again. January futures are higher by +1.00 to 70.27 [+0.46%] at the time of writing. Catalysts for the rally Russian – Ukraine fears. Early this morning Ukrainian authorities reported the Russian use of an intercontinental ballistic missile for the first time in the war. ICB’s and their use has been a sore spot for Nato & the U.S for years and the strike will likely elicit a response out of the rest. The macro environment is mixed to risk-on today with Gold higher by +0.40%, S&P’s +0.24%, Copper -0.44%, 10Yr’s lower by -1.37bps at 4.396%, and the DXY lower by -0.08%. The commodity complex desperately needs this dollar strength to ease. Yesterday’s EIA report showed a reversal of the hot product demand trend while Crude Oil demand ramped on increased exports. U.S. stockpiles remain near record lows. Figures are as follows [thousand bbls]:

{EIA Crude Oil Stockpiles; EIA Gasoline demand}   WTI Crude Oil futures are running into major three-star resistance at 70.11-70.42. Although it has so far slowed down the overnight rally, we see a landscape in which prices fundamentally and technically can continue higher into the weekend. To hold a most constructive path, we would not like to see the bottom end of yesterday’s EIA release whipsaw (68.97) to be surrendered. Furthermore, we envision the bulls decisively in the driver’s seat as long as price action holds our Pivot and point of balance at… Want to stay informed about energy markets? Subscribe to our daily Energy Update for essential insights into Crude Oil and more. Get expert technical analysis, proprietary trading levels, and actionable market biases delivered straight to your inbox. Sign up now for free futures market research from Blue Line Futures! Sign Up for Free Futures Market Research – Blue Line Futures On the date of publication, Bill Baruch did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|